Inside Batch Ventures’s patch to building a next-gen VC engine

Founder & GP at Batch Ventures on deploying a YC-first thesis, mastering AI in products, and the US vs European startup divide

Hey, I’m Timothe, cofounder of Stellar & based in Paris.

I’ve spent the past years helping 500+ startups in Europe build better product orgs and strategies. Now I’m sharing what I’ve learned (and keep learning) in How They Build. For more: My Youtube Channel (🇫🇷) | My Podcast (🇫🇷) | Follow me on Linkedin.

If you’re not a subscriber, here’s what you’ve been missing:

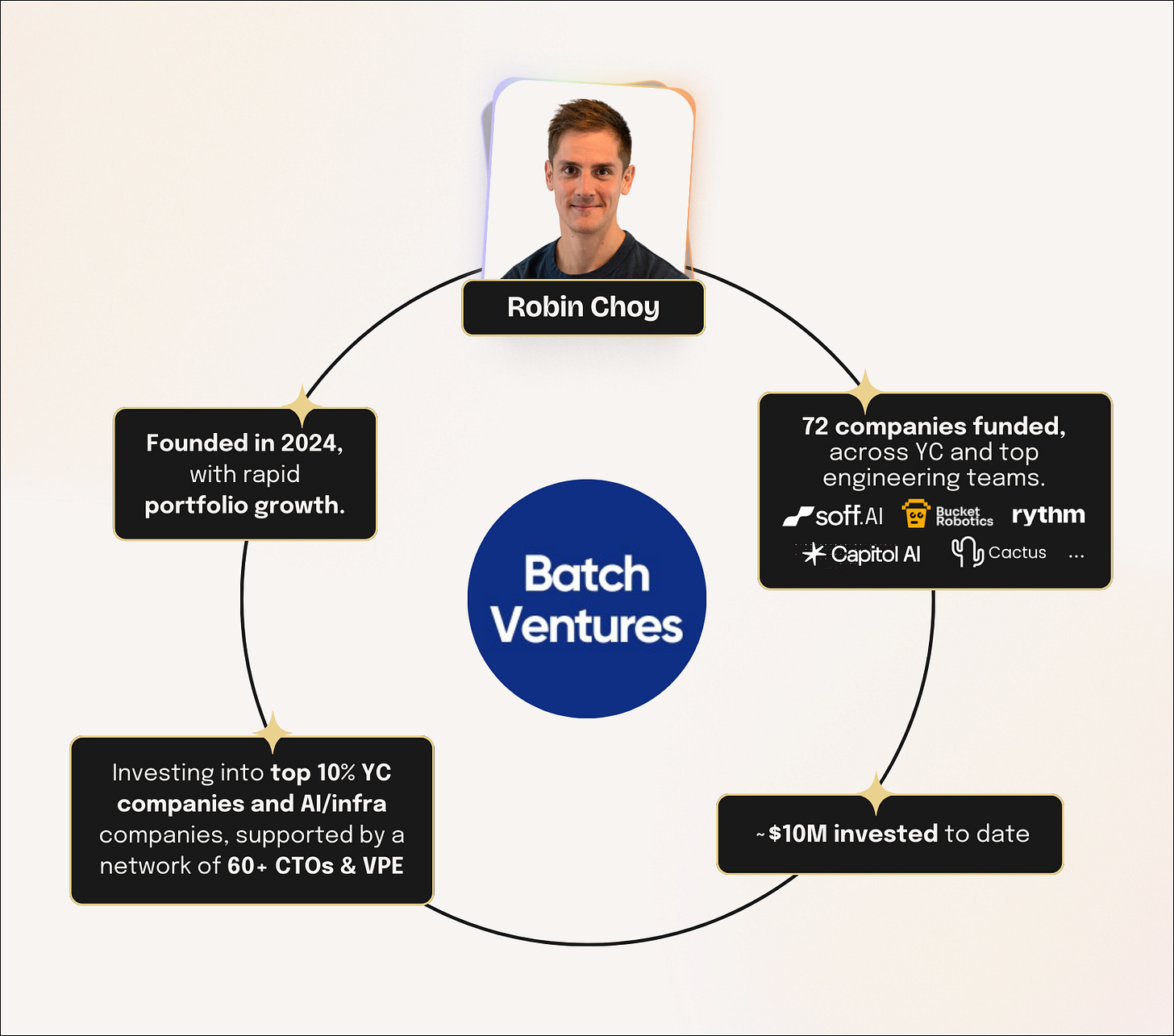

Founded in 2024 by Robin Choy, the mission of Batch Ventures is to reinvent venture capital by backing founders from the world’s best networks with speed, operational insight and product-obsessed support.

Batch Ventures focuses on investing in early-stage tech founders (especially from YCombinator or enterprise software/AI backgrounds). I differentiates by being deeply embedded in founder networks and offering product + distribution insight rather than just capital.

Milestones timeline:

September 2024: Robin Choy founded Batch Ventures with a YC-focused fund

2024: Launch of “CTO Fund” targeting infrastructure/AI, supported by a network of 60+ CTOs & VPEs, led by Quang Hoang

2025: Launching a new YC fund for 2026 companies

Ongoing: Investing into top 10% YC companies and AI/infra companies via their network-led thesis.

I sat down with Robin to discuss the evolution of next-gen venture capital, the rise of AI in product, and the differences between European and US startup ecosystems.

Disclaimer: The organizational choices and technical solutions shared in this newsletter aren’t meant to be copied and pasted as-is. Always keep your company’s context in mind before adopting something that works elsewhere! 😊Backstory

Robin’s journey is rooted in founder-to-founder empathy. Before launching Batch Ventures, Robin built and scaled his own startup (the recruitment tech company HireSweet), became a YC alumnus (YC W20) and learned the rigour of product-market fit, distribution and culture firsthand.

That perspective shaped the founding thesis of Batch Ventures: what if you built a VC fund not just around capital, but around network, product insight and speed of decision?

Early on, the focus was on YC: Robin initially invested in around 50 YC companies, building deep familiarity with the network and its dynamics. This led to the launch of a second vehicle, the CTO Fund, led by Quang Hoang and backed by a community of 60+ CTOs and VPs of Engineering from leading Bay Area startups (including Intercom, Datadog, Checkr, Netflix, GitLab, and Discord). Across both efforts, the emphasis has been on identifying strong founder signals—such as momentum, mindset, and distribution capability—while maintaining a fast decision-making process (they claim 90% of decisions within 24 h for the YC Fund).

In that sense, Batch Ventures is less about being a generalist large-fund investor and more about being a specialised, high-velocity partner for high-potential founders. The focus on AI/infrastructure via the CTO Fund, and on the top tier of YC via the YC Fund, reflects that strategic choice.

“Investing used to be personal and focused. It’s become a numbers game … great investing still means backing exceptional founders, providing real value, and being in the trenches” as Robin puts it.

This orientation matters especially when comparing ecosystems: in the US (and particularly Silicon Valley/San Francisco) you find dense networks, rapid decision loops, brutal competition for founders and distribution moats emerging quickly. In Europe, many of those layers are still less mature, which means the path and timing differ. Robin emphasised that being “in the right place at the right time” in San Francisco mattered significantly to capture the best opportunities, and that distribution, not just product or tech, is becoming the new moat.

That founder-to-investor evolution is the crucible behind Batch Ventures’ thesis: backing founders who are product-and-distribution obsessed, network-enabled and positioned for AI-first growth.

Why distribution becomes the moat

One of the core product moves Robin discussed is the shift from building product features to building distribution systems. He argues that while many early-stage companies still focus on product-market fit in the classic sense, the winners today layer in a distribution mindset from day one.

For instance, a YC company with a great product but zero BUILT-IN route to scale will struggle compared with one that embeds acquisition, retention and network effects early. Robin noted that in his view “momentum matters more than perfection” when you’re dealing with YC-tier companies. He explained that many founders underestimate the speed and distribution engine required to convert product into growth.

He further emphasized that being physically embedded in San Francisco and plugged into the ecosystem gave founders a distribution advantage: access to early users, key engineers, product talent, customer networks and the “right-time” syndrome. The point: a founder who launches an AI product in 2025 versus one who did in 2022 may find drastically different outcomes because of timing, adoption curves and signal scarcity.

Actionable takeaway: If you’re founder-led, build not just features but a distribution machine (content, network, growth loops) from day zero. Evaluate every product move by how it feeds acquisition and retention, not just engagement.

AI as the expectation, not the option

Another key product move is the belief that AI is no longer optional. Robin sees AI as table stakes for many tech infrastructure and software companies. The reasoning: with the foundational models now broadly available, the competitive differentiation moves to how you embed AI in product, lean on technical differentiation, data strategy, and build for scale. In his words, “AI is no longer an option but an obvious checklist item”. He argues that companies without an AI component risk being seen as commodity.

In the European context, one of the challenges is that many founders build “non-AI” products or incremental features, which may lag the US where AI adoption is more aggressive and expectations higher. For investors like Batch Ventures, the signal is emerging quickly: record-breaking valuations for AI infrastructure and tooling (referenced in Robin’s social posts around the IPO of Vanta at ~$2.45 bn).

The implication: founders must embed AI thinking, not later, but early — both technically (model/data infrastructure) and culturally (team, roadmap).

Actionable takeaway: If you’re building a software product today, ask yourself: where does AI sit in my roadmap? Is it a bolt-on or a foundational layer? How will my competitors treat it? How will it scale?

US vs Europe — the ecosystem gap

A major theme Robin emphasized is how the US and Europe differ today in startup dynamics, especially at early stage. Key contrasts he highlighted:

Timing & momentum: In the US, especially in the Bay Area, you get rapid feedback loops, access to large markets, early hairpin distribution opportunities and a network effect-rich ecosystem. Europe often has fragmented markets, slower momentum and less concentration of engineering/product talent.

Founder velocity: He noted that YC-backed teams often move from idea to small traction extremely fast in the US context (“1-15 M ARR in a year is top 0.1%” – Robin Choy on LinkedIn). European teams may have deeper structural advantages (e.g., cost efficiency, regulation comfort), but the speed differential remains a gap.

Distribution and global scale mindset: US founders often think globally from day one; European founders may default to national or regional markets before expanding, which gives US teams a head-start in global network effects. Robin says that distribution becomes the moat and that means being in a dense network like San Francisco helps dramatically.

Network signal: For investors like Batch Ventures who back top-10% YC companies and AI infrastructure, the US ecosystem is ahead both in signal (deal-flow quality, founder experience) and in network effect gravity. Robin’s choice of being based in SF and embedding into local ecosystem reflects this reality.

Actionable takeaway: European founders should consciously build for global scale and invest in distribution/network early. Investors looking in Europe should be aware of the speed gap and focus on founders who can close it.

Build your distribution engine before you scale your product features. Speed without reach is hollow.

Treat AI not as a bonus but as a core architectural layer from day-one if you’re in software/infrastructure.

The San Francisco network effect still matters: physical proximity to talent, customers and momentum gives you access European founders may lack.

When comparing US vs Europe, founders must adopt a global mindset immediately. They can’t default to local markets if they want to compete.

As an investor, specialising into networks (YC alumni, CTO communities) gives you structural advantages in signal, decision speed and value-add.

For founders, pitching to such specialist investors means showing momentum, distribution traction and a product-centric team.

Momentum matters more in top-tier ecosystems: getting from idea to ARR quickly signals both capability and market fit.

Don’t raise a large fund or scale rapidly if you haven’t built the foundation of product, team cohesion and distribution loops. It leads to hitting a glass ceiling.

For European startups, network scarcity means you must invest more consciously in access, talent and global rails.

The future of venture is shifting: from generalist capital to network-led, founder-obsessed, product-oriented funds.

If you’re a founder or early investor, ask yourself: what network am I indexing into? How fast can I move? What’s the moat?

Building the brand, being in the right ecosystem and choosing the right investor thesis are as important as the idea itself.

Focus on team dynamics early: ask structured questions like “tell me a time you had conflict and how you resolved it” (Robin Choy).

European founders have opportunity advantage in cost and regulation, but must convert that into speed and distribution if they want to match US peers.

For VCs: being value-add means more than cheerleading. You need network activation, product insight and operational empathy from a founder perspective.

My full interview with Batch Ventures, Founder & GP

Dive deeper into this topic with Robin Choy, Founder & General Partner of Batch Ventures, in my latest podcast episode:

Enjoyed this newsletter? Share it with your network using the button below—your support means a lot!